U.S. Revenue Increases While Deficit Heads for Record

WASHINGTON — Despite a larger-than-expected increase in tax revenue, the federal budget deficit has grown by about $70 billion and will hit a record $445 billion this year, the White House projected Friday.

The Bush administration put the new numbers in a positive light, saying its tax cuts had strengthened the economy and resulted in a deficit significantly lower than the $521 billion it projected in February.

“Because the president’s economic policies are working, we are ahead of the pace to meet the goal of cutting the deficit in half within five years,” said Joshua B. Bolten, director of the Office of Management and Budget.

But deficit hawks strongly disputed that interpretation. They said the administration’s previous deficit projection was inflated. In addition, its budget projection for the next five years is suspect because it did not include several major spending items, such as funding for the military conflicts in Iraq and Afghanistan.

“The deficit has just gone up by a huge amount,” said Robert L. Bixby, executive director of the Concord Coalition, a nonpartisan group that advocates balanced budgets. “That is what policymakers and the public need to concentrate on.”

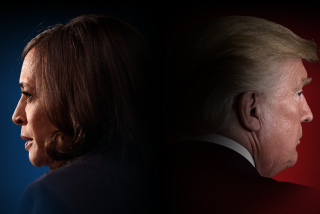

The presidential campaign of Democrat John F. Kerry used the report to criticize President Bush’s handling of the federal budget and the economy.

“Even worse than this record deficit is the record deterioration George Bush has caused for the long-term fiscal health of the country and his lack of any plan to restore fiscal discipline,” said Kerry economic advisor Gene Sperling.

But budget analysts faulted the budget proposals of both presidential candidates, saying the Republican and Democratic approaches were based on unrealistic and incomplete assumptions about government spending and tax policies.

“It looks unlikely to us that the deficit would be cut in half under either the Kerry or the Bush administration proposals,” said Robert Greenstein, executive director of the liberal Center for Budget and Policy Priorities.

OMB director Bolten said the administration’s fiscal 2005 budget estimate includes Bush’s request for an additional $25 billion for emergency spending in Iraq.

“We will need additional money in Iraq and Afghanistan, certainly in ‘05, maybe even in ‘06,” Bolten told reporters. “And so as you look at these numbers, you have to ... factor in that we will need to have that additional military spending in the budget.”

But, he said, “We do not believe that that additional spending, whatever level it may end up being, in any way jeopardizes our objective of doing better than cutting the deficit in half over the next five years.”

Stanley E. Collender, an independent budget expert and author, predicted that the deficit would remain near the current level or even increase over the next five years if military spending, tax-cut extensions and more realistic estimates of domestic spending were included in the projections.

The White House released what is known as the “mid-session review” of the federal budget a few hours after the Commerce Department reported that the U.S. economy grew at a 3% annual rate from April to June, the slowest in more than a year.

Even with those numbers, Bolten said, the U.S. economy is “strong and growing stronger [because] the president and the Congress acted and let the American people keep more of their own money to save and invest.”

But Greenstein said the expected increase in federal tax revenue -- $82 billion more than the administration’s previous projection -- had more to do with inflation than stronger economic growth “because that has not occurred.”

In addition to a higher-than-expected rate of inflation, Greenstein said, revenue was boosted by the concentration of economic growth among higher income levels. Income tax revenue increased but the collection of payroll taxes, which is a better reflection of economic activity among middle- and lower-income Americans, was lower than projected, he said.

While this year’s $445-billion deficit would represent the nation’s largest budget shortfall in dollars, Bolten said that amounts to 3.8% of the total economy, well below the record 6% reached in 1983 under President Reagan.

The 2003 budget deficit of $375 billion was 3.5% of the gross domestic product.

The federal fiscal year ends Sept. 30, which should make the final 2004 figures available shortly before the Nov. 2 election.

The last time the government reported a budget surplus was 2001, when it spent $127 billion less than it took in. In 2000, the government ran a $236-billion surplus.

Over the next five years, the White House said, the deficit will be gradually reduced: to $331 billion, or 2.7% of GDP, next year and $229 billion, or 1.5% of GDP, in 2009.

Over the same five-year period, the administration increased its estimate for spending on the government’s largest entitlement programs -- Social Security, Medicare and Medicaid -- by $116 billion. Most of the $60-billion increase in Social Security spending would be caused by inflation, which would increase cost-of-living adjustments for retirees, its report said.

“Technical corrections,” or changes in economic assumptions, and inflation accounted for most of the projected increases in Medicare and Medicaid spending, it said.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.