Tough timing for newlyweds’ search

Will and Gaby Smith didn’t honeymoon in Hawaii, Las Vegas or Mexico. Instead, the newlyweds, who tied the knot Nov. 9, spent the first weeks of their married life driving through neighborhoods in Orange County with a Thomas Guide and real estate listings in hand.

And why not? The Hawthorne couple, who have a 9-month-old son, has walked through about 60 open houses and previewed hundreds of homes on the Internet since their engagement about a year ago.

“We want a place so we can get settled,” Will said. “We want something with a lot of land. I have memories playing baseball and football in my own backyard. I remember how important it was [as a kid] to have all that space.”

Beyond blissful domesticity, the Smiths are motivated by low interest rates. But as home prices in Southern California have reached record highs, Will is having second thoughts.

“The prices for homes are ridiculous right now,” said Will, 31, a computer training specialist for Hoag Memorial Hospital Presbyterian in Newport Beach. “I want to take advantage of the rates, but still I worry that right now might not be the right time.”

Still, apartment living has gotten tiresome. They worry that little William wakes neighbors at night when he cries, and they can’t predict when their rent will go up. On top of that, the hour or more commute to Will’s job 45 miles away is starting to wear on him.

“It’s tough leaving home in the morning before the sun comes up and getting home after it’s already down,” Will said.

The couple fear that getting a loan will be difficult. Will has three items on his credit report that he is disputing. Totaling $3,500, they amount to nothing more than financial mix-ups: a deposit on a cell phone that should have been used for a final bill, a $3,000 student loan that was supposed to be forgiven but wasn’t, and confusion on a corporate American Express card charge that should have been paid by his previous employer.

Will, who grosses about $4,000 a month in salary and other consulting work and is the only wage earner in the family, also is concerned about his newness in his job: He’s only been at Hoag since August. Additionally, because the couple has only about $8,000 in cash in money market accounts, an IRA and savings, they will have to rely on Will’s mother to assist with a down payment, money she will have only after refinancing her home in Gardena.

Despite the Smiths’ concerns, Maria Gain, an assistant vice president of Real Estate Originations with Mission Federal Credit Union in San Diego, was able to approve the couple for a 30-year, fixed Federal Housing Administration loan of $199,500 at an interest rate of 5.5%. That will allow the Smiths to purchase a home for $210,000. “With an FHA loan, we are getting an approval, and we don’t even have to have the disputed items resolved,” Gain said.

According to Gain, an FHA loan is more forgiving on credit issues compared with a conventional loan. And Will’s new job isn’t an issue because he had worked in a similar position for 3 1/2 years, she said.

“All Will did was move to another employer, but he’s doing the same thing,” Gain said. “He could have been on the job one week and it wouldn’t have mattered.”

The loan will require 5% down, roughly $10,500, and about $5,500 in closing costs. The couple’s monthly mortgage, padded for expected homeowner’s fees for a condo or townhome, would run about $1,573 -- more than double the $705 the couple pays for their one-bedroom apartment. That monthly payment would represent a 49% income-to-debt ratio, the percentage of the Smiths’ gross monthly income for housing and all other living expenses. Gain felt that ratio was high but workable since Will’s income will increase with raises and bonuses in his job.

“I’ve seen ratios approved at 50% or 60% total expense,” Gain said. “But I like to caution buyers to make sure they feel comfortable with that large of a house payment.”

To secure the deal, Will’s mother would need to send a signed letter to Mission Federal stating the money she is giving Will and Gaby from refinancing her home is a “gift” and not expected to be repaid. Mission Federal would additionally need to verify Will and Gaby had received those funds before the close of escrow.

Even with the financing issues resolved, they know from their yearlong search that buying a home in that price range in Orange County will be hard.

Finding a single-family home for $210,000 will be impossible, according to Mary Jane Cambria, a Realtor and broker with Star Real Estate in Huntington Beach, who recommended a townhome instead.

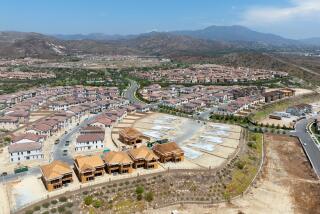

Although the couple would prefer a single-family home with a big yard, they said they would consider townhomes, provided they were in a nice area, such as Rancho Santa Margarita.

But living there may be out of reach. According to DataQuick Information Services, a La Jolla research firm, the median price for a condo there has more than doubled from $100,000 in 1996 to $240,000 today.

Even though Cambria said that appreciation in the community had slowed somewhat, she predicted prices will continue to go up steadily and recommended the couple buy now rather than wait.

She was able to find five townhomes listed in the area that matched the Smiths’ minimum criteria of two bedrooms, one bath and a garage.

The townhomes ranged from 847 to 920 square feet and were priced between $214,000 and $224,900 -- still within the Smiths’ range if they made a low offer. “We can hope,” Cambria said of offering under list price. “But in this market, sellers aren’t budging much.”

Cambria then widened her search and located six similar townhomes between $192,000 and $225,000 in Fountain Valley, Huntington Beach and Santa Ana. The properties were a little bit larger, ranging from 796 to 1,107 square feet.

But Will and Gaby disliked all of the homes. Some of the Rancho Santa Margarita townhomes, they said, had poor floor plans with too much of a separation between the master and baby’s bedrooms. Others, they said, were in neighborhoods they felt were on the decline.

In the end, Gaby and Will decided to risk prices rising further and rent an apartment in Costa Mesa, five minutes from Will’s work, for just $100 more a month.

“I have the patience to wait out the storm,” Will said. “I have the patience to wait for a good deal.”

*

Buyer make-over at a glance

Makeover subjects: Gaby and Will Smith.

Occupations: Gaby Smith, 26, a stay-at-home mother; Will Smith, 31, a computer training specialist at Hoag hospital in Newport Beach.

Gross monthly income: $4,000 from salary and other consulting work.

Goal: To purchase a single-family home in Orange County, preferably in Rancho Santa Margarita.

The problem: Will is new in his job and has collections on his credit report that he is disputing. The couple has limited funds for a down payment and worry that home prices in Orange County are out of reach.

Recommendations:

Buy now to take advantage of low interest rates. Homes continue to appreciate; you will probably pay more for the same house a year from now.

Look into an FHA loan, which can be more forgiving of previous credit problems. If you must change jobs and are planning to buy a home, try to stay in the same field or career to show consistency.

Research homes and neighborhoods on the Internet. Narrowing areas down can make the search more efficient.

Meet the Experts:

Maria Gain has been with Mission Federal Credit Union in San Diego for 22 years. She is a member of the San Diego Mortgage Brokers Assn. and a member of the Assn. of Professional Mortgage Women.

Mary Jane Cambria has been in the real estate business for 15 years with Star Real Estate in Huntington Beach. Cambria specializes in Costa Mesa, Huntington Beach, Fountain Valley and Newport Beach.

*

Allison B. Cohen is a Los Angeles freelance writer.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.