A Happy Ending for the Home of Happy Feet? : How a couple’s struggle to keep a dance studio open forced them to push personal and community assets to the limit

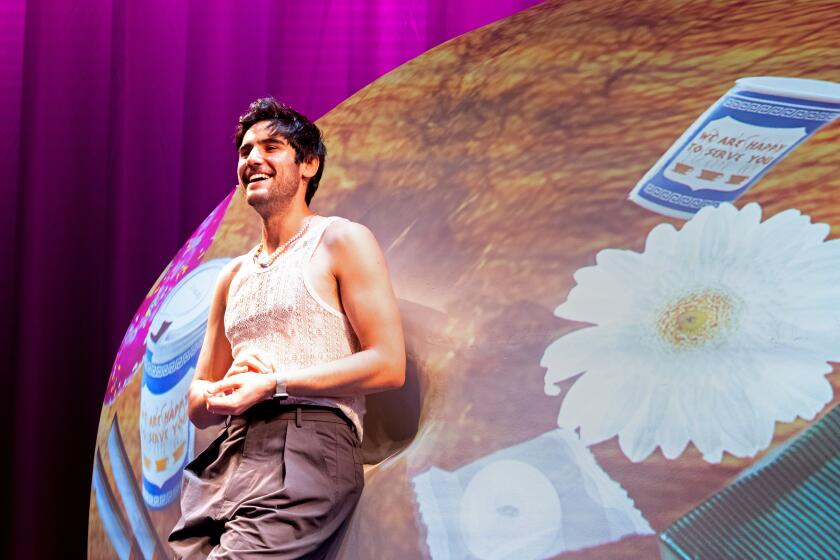

Several days a week after school, neighborhood children grab their dance clothes and head for Lula Washington’s L.A. Contemporary Dance Theatre studio on West Adams Boulevard. There they climb the stairs of the former Masonic lodge, home to her school and 10-year-old performance company, to join in ballet, jazz, modern and tap dance classes.

The old brick building, which could have been lifted right out of the movie, “Tap,” is warm and bright with sunlight and life. The floors are well-worn from years of dancing feet and music reverberates off walls covered with candid photos of dance performances. Children clatter excitedly through the hall to and from class, while their parents gather to watch them and exchange neighborhood information.

Regular tenant troupes include Ogundo and Company, Djimbe West African Dance Company, Karen McDonald New Age Dance Workshop and Light Dance Company. Onaje Murray, who runs Onaje’s Gift Shop on the upper floor, sells African artifacts, gift items, body oils and wood carvings. Community groups present fashion shows and an occasional music video company rents the hall for auditions and rehearsals. And registered for classes are about 75 latchkey kids who--without the studio--would be growing up on the streets.

The studio’s cheerful, bustling atmosphere is quite different from what Washington found when she took over the building in 1982. Then her students had to climb over drunks and drug addicts on the stairs, and down the street a storefront operation dispensed illegal drugs. It took seven years of effort, she says, to clean up the block, an effort that was almost wasted recently when her studio was close to extinction, a victim of skyrocketing local land values.

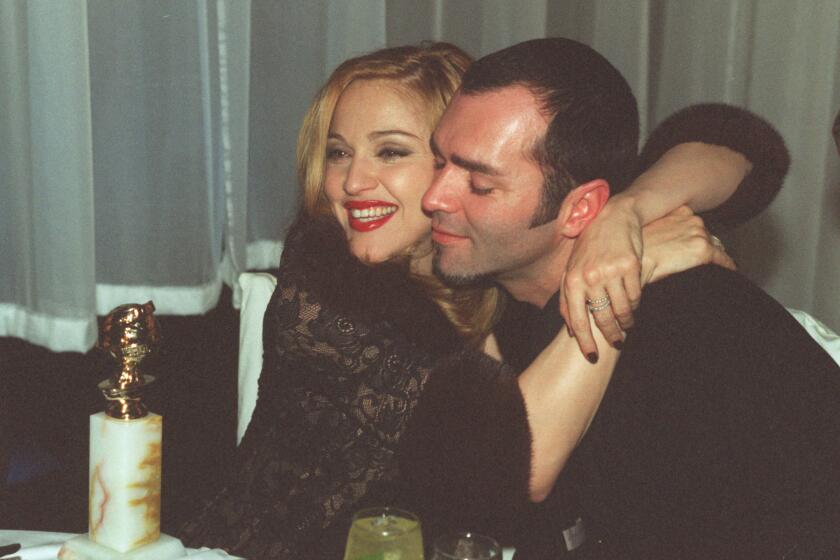

One day last June a “For Rent” sign suddenly appeared on the structure. Alarmed, she and her husband, writer Erwin Washington, contacted the realty office. Erwin says: “We were told that the owner, (actor) Taurean Blacque, was selling the building for real estate value only and it was likely to be torn down, so we knew that our continuing there was in jeopardy.”

And so a six-month saga began to find new quarters, punctuated by adversity, hope, despair, red tape, incessant delays and grass-roots determination. Washington’s dilemma was all too familiar in this era of steadily diminishing arts spaces. As a veteran dancer/choreographer/teacher, Washington has watched the real estate squeeze force several other dance studios to disband, double up or move to smaller, usually more expensive quarters.

Unlike other studios, the L.A. Contemporary Dance Theatre prevailed. On Dec. 11, the Washingtons purchased the $225,000 building--after pushing personal and community resources to the limit and mortgaging their home. But the saga isn’t over yet. For, while the Washingtons say that their triumph was exhilarating, they are still faced with the prospect of constant fund raising to meet their new obligations.

Lula says: “We’re excited that we finally crossed this hurdle, but we know we still have to cross the mountain, and we’re very scared.”

Nevertheless, the Washingtons’ quest to buy their building offers an object lesson for other endangered arts organizations. With determination and resourcefulness, they tapped into various government and community sources to raise what amounts to a down payment on their future. Their story shows that it can be done.

The Washingtons decided that with all that time, energy and neighborhood rapport invested in the building, they were reluctant to move away and start over. After all, Lula says, “Finding a place with good floors that lends itself to dance is a serious problem, and that building has great space. R’Wanda Lewis had her dance studio there for years before we took over the building.”

And there were more reasons for staying. Besides LACDT and a program for latchkey kids, the studio houses adult and children’s dance classes and performance groups, and also rents space to other arts groups. With an elementary school across the street and a bus stop in front of the door, the building is a community focal point. As Lula says, “My main purpose in starting the school in 1983 was to be in the community, in a place where people who needed us had access to us.”

“Lula provides the quality teaching and discipline necessary to develop raw talent,” says parent Stella Smith. “I’ve seen her take neighborhood kids and transform them into beautiful, well-trained dancers. There is just no other school like it close by.”

The Washingtons explored alternatives, and even considered closing the studio, halting the community programs and renting rehearsal space as needed for the nine-member company. Lula says: “When I’m discouraged I wonder why I’m doing this.

“It would be easier to just rent space a couple of days a week in some plush Beverly Hills or Valley studio, or I could . . . choreograph for movies and videos. I’ve done that, but it was empty and unfulfilling work. I feel like I have to give back something to my community.”

They looked at other buildings, but found smaller, inappropriate spaces for quadruple their $600-a-month rent. With trepidation, but craving permanency, stability and freedom from rental market vagaries, they decided to take a giant step and buy the building, even though they had no money.

As Lula recalls: “We said to the broker, ‘We want this space. Give us a chance to get it.’ He just laughed.” However, on July 1 the Washingtons scraped together $1,000 and opened escrow. Then the drama began in earnest.

“We checked with about 25 to 30 banks,” says Erwin, “and they all discouraged us from even applying for loans because we’re nonprofit and have no collateral, and because the earthquake upgrading would cost an additional $150,000. No one would lend money on such a building and everyone said, ‘Forget it. There’s nothing that can be done.’ ”

At the same time they were encountering reluctance from their board of directors, who were opposed to the purchase of that particular building. Erwin says: “No one wanted to buy it. It’s old, they didn’t like the neighborhood and they thought it wasn’t worth the price. But we found that buildings of that size in worse neighborhoods cost twice as much, so this was a bargain and we didn’t want to lose it.”

Says opposing board member Robert Johnson, who eventually decided to support the effort: “At the time we voted on whether to pursue this, it did not appear to be a good choice, simply a convenient choice. It was where we were, and an opportunity to continue without a break in our activities. Other than that it had a lot of drawbacks, a fundamental one being that as property owners, we have to generate income to pay the bills. This building, as a rehearsal and training space, generates virtually insignificant revenue.”

Ultimately, however, the board approved, the Washingtons told Blacque they’d pay cash, and he agreed to their offer, setting Sept. 11 for closing.

Now it was time to put up or give up. With traditional lending institutions out of the question, the couple decided to use knowledge gained at arts fund-raising conferences to seek out corporate and community grants and loans.

They went to L.A. County Supervisor Kenneth Hahn, who awarded them a $20,000 Community Development block grant. Hahn’s senior deputy, Burke Roche, says: “There are plenty of dance classes, but not of this nature, where they concentrate on bringing in kids from the street and teaching them to dance and perform.”

L.A. City Councilman Nate Holden’s office also helped with $10,000 which was used for rent. Herb Wesson, Holden’s chief of staff, says: “We’re impressed with what they’ve been able to do on a skeleton budget. Theirs is the type of program that kids who aren’t great football, basketball or track stars can succeed in. We definitely need to keep this place.”

While the board was still doubtful, it was fearful of losing the childrens’ programs, so committees were organized and an exhaustive summer program of weekend fund-raising performances began. A big break came when board member and former dancer Donald Stinson promised a $25,000 loan. He says: “Lula has a good reputation in the community. Her free program for deprived and under-privileged children has grown a lot, which shows the importance of having it there.”

As the summer weather heated up, so did the Washington’s efforts. For the first time, Erwin says, the goal seemed reachable. Soon other board members and their friends began pledging. “We’re a small board and not very rich,” says board member Alice Duff, “but we tried to network with our colleagues, friends and relatives.

“We were too committed to let it drop and I think especially with the death of Alvin Ailey we have a renewed sense of how important it is to keep our dancers going. Lula makes sure her instruction is available to people who wouldn’t otherwise have it and she’s critical to our community.”

Studio supporters found different ways to contribute. Some company members and teachers performed and taught for free, students helped out at fund-raisers and parents made phone calls, worked on proposals and held bake sales.

The hard part for her, Lula says, was asking for loans. “We were scared to do it, but we had to learn to beg. Alvin Ailey, my friend and inspiration, always encouraged us to get our own space and told us he begged all the time.”

The Ahmanson Foundation gave a $25,000 grant and producer Robert Greenwald loaned $5,000 after reading a newspaper article about the effort. He explains: “I grew up on the toughest New York streets where there were no artistic possibilities and I have a sense of the environment Lula’s working in. As someone in the performing arts world I felt a kindred spirit. I wanted to support her because I feel people like that are genuine heroes and heroines.”

Funds were accumulating, but according to Erwin, although Blacque was supportive and wanted to sell to them, he was getting temptingly larger cash offers from new potential buyers. As three deadlines came and went, he grew impatient.

“I liked what they’re doing and I did want to keep it in the community and in the arts,” Blacque said. “They’re opening up a lot of avenues for future artists, and if I can be of assistance, I will be.”

Finally time ran out and, Erwin says: “with nowhere left to get money fast we were still $65,000 short. We had no other choice then but to mortgage our house, although our board objected. In mid-October we began the process of refinancing, which caused delay after delay for appraisals and loan requirements.”

Even after final approval, the house raised only $59,000 and Erwin says other unexpected technicalities kept popping up, a blizzard of paper work creating even more delays. And in the background, better-financed buyers circled like sharks, waiting for the Washingtons to sink.

Finally the day came. On Dec. 11, $158,000 down payment in hand, they met with Blacque’s broker in his office, only to find, to their shock, that they were $800 short because of last-minute unanticipated charges. With $50 left in their bank account, things looked shaky for the couple until the broker and owner of the escrow company together chipped in the final amount. At that point everyone in the office, including brokers who had tried to obtain the building for their own clients, applauded and congratulated the dazed Washingtons, and the building was theirs.

Happy ending? Happy, yes. Ending, no. With depleted resources the Washingtons now must find more funding to cover the balance of purchase, renovation costs, loan repayments and a $2,500/month mortgage payment.

Part of their future strategy involves renting out space in the four-unit building, which presents an ironic ideological conflict. “An original goal,” says Lula, “was to rent to people in the arts, but then our board thought if arts tenants were struggling as much as we are, they might not be able to pay the rent, and that would kill us. We’re still up in the air about that one.” Also being considered is a plan to tear down and rebuild, tailored to their own needs, thus avoiding earthquake renovation costs.

Looking back at the past six months, the Washingtons are surprised and grateful for the extent of community support they found. They plan a studio open house Jan. 13 from 4 to 7 p.m. to discuss their plans.

Erwin says, “Except for the large grants, all this was funded through little people. Now we feel there’s no limit to what we can do.

“But what’s really important about our story is not just that we did it. We hope this will motivate and inspire other artists to buy property. If they don’t, Los Angeles real estate speculation will cause prices of arts spaces to go so high, small arts groups will be driven out of business.”

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.